Indirect Tax Services

We gladly support you with all things Indirect Tax, including:

On-call Indirect Tax advisory – A broad palette of on-call services regarding VAT, Insurance Premium Tax, Real Estate Transfer Tax and Customs

Indirect Tax compliance – Assistance with the preparation and filing of tax returns and other reporting obligations

Interim Indirect Tax Management – In-house indirect tax support (for special projects or resource replacement)

Indirect Tax audit support – Coordination assistance in the event of a tax authority audit

Financial Services & Real Estate – Specialty VAT and Insurance Premium Tax support with complex financial, insurance and real estate transactions

Mergers & Acquisitions VAT support – Due diligence, structuring, contract reviews and other transaction work

Controversy – Assistance with tax authority disputes and tax litigation

Indirect Tax training – Develop your finance & tax teams through training tailored to your needs

Indirect Tax health scans – Deepening insight in your company’s Indirect Tax position

Tax Control Framework – Building a process and control framework for the effective management of Indirect Tax

Tax & Technology – Indirect Tax automation (system configuration support for tax determination and compliance)

Other Tax Services

Although our sweet spot is Indirect Tax, we do provide assistance with other tax matters, such as corporate income tax, linked to our clients’ indirect tax issues. We also happily bring you in touch with members of our ever-growing network of partner firms, whose core values are aligned with ours.

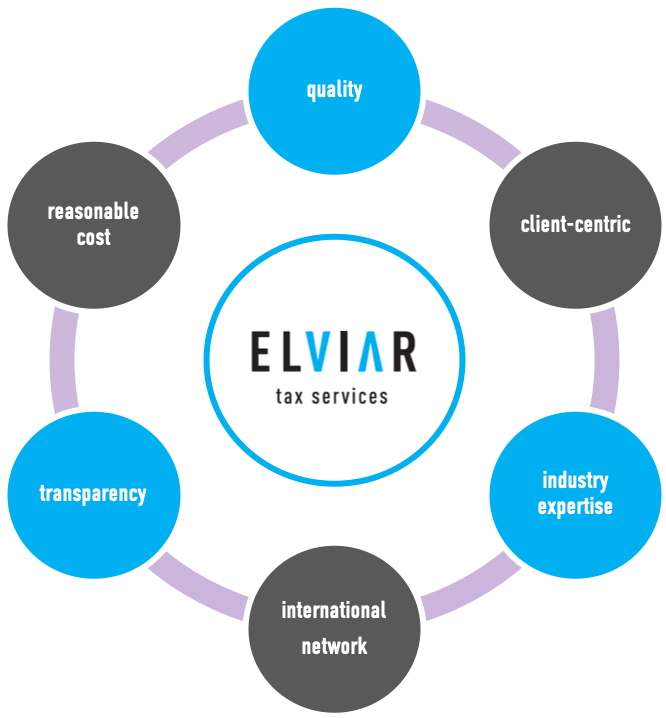

The Elviar Way

We aspire to deliver unparalleled value in Indirect Tax services. That goes beyond providing the prerequisite technical expertise for solving complex tax issues. It is about understanding your industry and organization, and taking into account your unique wishes and constraints in the practical solutions that we seek. That requires a client centric approach through which we aspire to enhance your perspective and achieve solutions that promote long-term success.

Our commitment to creating value in Indirect Tax is exemplified by reasonable rates / fee arrangements for our services.

Pricing

For our services we charge a fee based on the time spent at the applicable hourly rate. In certain instances additional expenses, such as travel costs, may be incurred, which we add to the fees for our services. Other fee arrangements may be agreed upon should that be opportune in the circumstances at hand. This could for instance be a fixed fee or a no-cure-no-pay arrangement.

We strive for transparency in everything we do. Ask us for a fee quote for your indirect tax project.